what is fit coming out of my paycheck

What is FIT tax. You can use the IRS withholding estimator which helps you to figure out if you need to give your employer a new W-4.

Digital Budget Planner Biweekly Paycheck Edition Lag Free Undated Digital Planner Budget Doctor Budget Planner Budgeting Finance Tracker

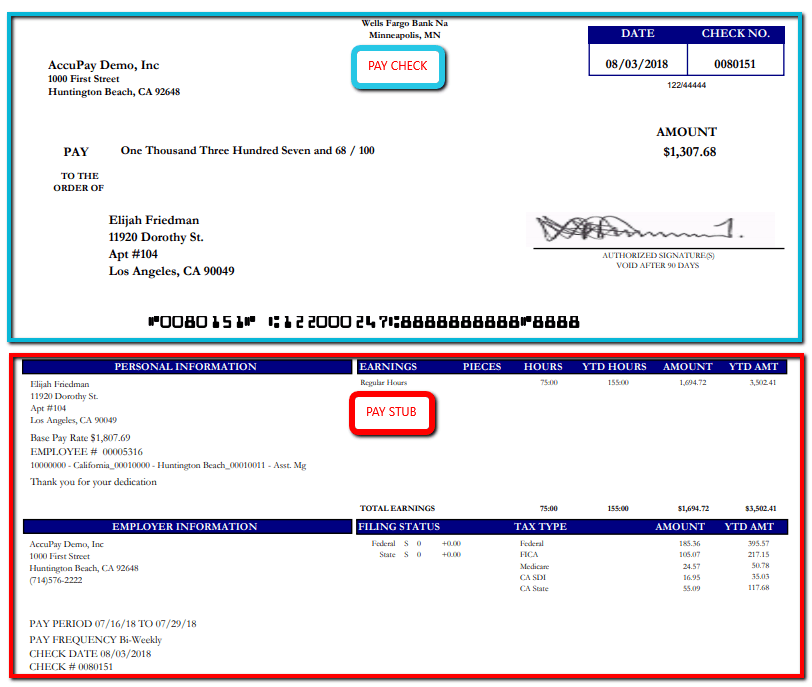

Federal Tax or Federal Tax Withheld.

. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. Your employer pays a matching FICA tax. FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax.

Thats because these events will likely affect the number of withholdings you claim. It is your employers responsibility to withhold taxes from your wages based on the W-4 you gave to your employer. You may want to give your employer a new W-4.

The calculation does not and cant consider variations in prior paychecks or future earnings for the estimated annual earnings employee could get a big raise or lose the job. What is fit coming out of my A paycheck. Youll get a refund if you have too much withheld.

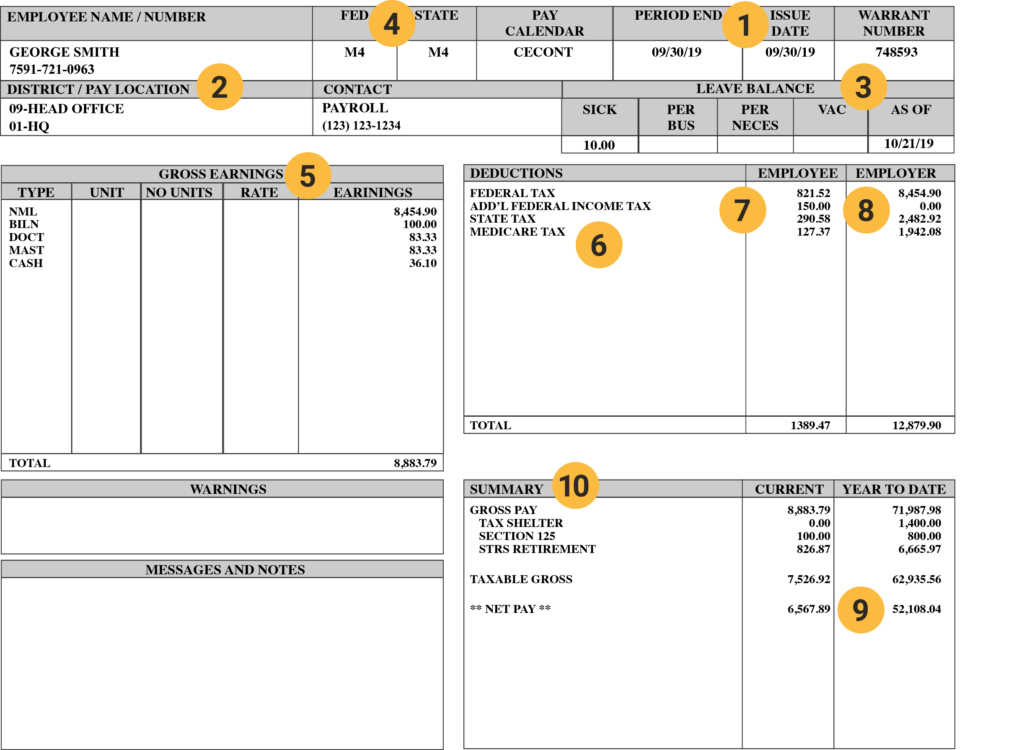

These accounts take pre-tax money so they also reduce your taxable income. The same is true if you contribute to retirement accounts like a 401 or a medical expense account such as a health savings account. Common Abbreviations Used on Paycheck Stubs.

Any Major Life Event. The overtime wage should be calculated at time and a half. Unformatted text preview.

Estimated annual earning 600 x 52 weeks 31200. If you failed to adjust your W-4 appropriately and it resulted in no federal income tax withheld from your paychecks you will likely owe the IRS money when you file your income tax return. Only your employer or the employers payroll department can tell why no taxes are being withheld.

Generally youll claim more if you get married or have a baby less if you get divorced. Insufficient federal income tax withholding can happen if youre married and you and your spouse both work but you didnt complete the Two EarnersMultiple Jobs Worksheet on page 2 of Form W-4. Taxable income 31200 25100 6100.

FICA is a US. Your goal in this process is to get from the gross pay amount gross pay is the actual amount you owe the employee to net pay the amount of the employees paycheck. IR-2019-178 Get Ready for Taxes.

With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. By completing that section of the form and stating the additional amount you want withheld from each of your paychecks on line 6 you avoid having too little tax withheld.

Get ready today to. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Federal Insurance Contributions Act.

For employees there isnt a one-size-fits-all answer to How much federal. Near your regular pay box you may see boxes labeled with overtime holiday and sick pay. The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees paychecks.

And is deducted from each paycheck. This means that the total FICA paid on your earnings is 124 percent for Social Security up to the earnings limit of 137000 and 290 percent regardless of the total amount you have earned. A paycheck to pay for retirement or health benefits.

More information is available from the Internal Revenue Service IRS at httpsappsirsgovapp. Go to this IRS website for the W-4 withholding estimator -https wwwirsgov. The amount of money you actually take home after tax withholding and other deductions are taken out of your paycheck is called your net income or take-home pay.

You might face penalties and interest as well. These taxes fall into two groups. This can show the hours you have accrued or that may come on a separate statement.

This will list any of the hours that you used during this pay period. State Tax or State Tax Withheld. These taxes include 124 percent of compensation in Social Security taxes and 29 percent of salary in Medicare taxes totaling 153 percent of each paycheck.

Free salary hourly and more paycheck calculators. Social Security or Social Security Tax Withheld. FIT tax pays for federal expenses like defense education transportation energy and the environment and interest on the federal debt.

Use PaycheckCitys free paycheck calculators withholding calculators gross-up and bonus calculators 401k savings and retirement calculator and other specialty payroll calculators. It stands for the. It is important to monitor the number of vacation and sick days.

Federal Unemployment Tax Act FUTA is another type of tax withheld. Federal Income Tax FIT and Federal Insurance Contributions Act FICA. How much is coming out of my check.

FIT on a pay stub stands for federal income tax. It allows you to adjust your withholding upward or downward. FIT deductions are typically one of the largest deductions on an earnings statement.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. FIT is applied to taxpayers for all of their taxable income during the year. As you work and pay FICA taxes you earn credits for Social Security benefits.

After you have calculated gross pay for the pay period you must then deduct or withhold amounts for federal income tax withholding FICA Social SecurityMedicare tax state and local income. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. You can have more withheld from your paycheck to cover you at tax time if you expect significant investment income or if you have other outside income thats not subject to withholding.

In the United States federal income tax is determined by the Internal Revenue Service. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. However FUTA is paid solely by employers.

Federal taxes are the taxes withheld from employee paychecks. Any time that you have a major life event such as getting married having a baby or getting divorced you should adjust your withholdings. Ariel SkelleyBlend ImagesGetty Images.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. Federal income tax is withheld from each W-2 employees paychecks throughout a tax year. Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck.

The amounts taken out of your paycheck for social security and medicare are based on set rates.

Paycheck Withholding Understanding The U S Tax Withholding System

Understanding Your Paycheck Youtube

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Focused On Being Broke Living Paycheck Get Fit And Fabulous With Lisa Love My Job Helping People Being Broke

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Paycheck Budgetfinance Gift Budget Plannerbudget By Etsy Budgeting Money Saving Tips Paycheck Budget

Understanding Your Paycheck Credit Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pin On Ways To Make Money Online

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Baketball Ate My Paycheck Baketball Gildan Heavy Blend Hoodie In 2021 Hoodies Unisex Fit Paycheck

Budget By Paycheck Paycheck Budget Printable Budget Template Paycheck Budget Paycheck To Paycheck Budget Budget Tracker Paycheck Sheet Budget Printables Budget Template Budget Planner Printable

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Budget By Paycheck Paycheck Budget Printable Budget Etsy Video Video Budget Planner Printable Budget Printables Planner Pages

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Budget Printable Paycheck Tracker Budget By Etsy Video Video Budget Planner Budget Planner Printable Budget Printables